- Overall Rating: 7.8/10

- Detailed Analysis of Customer Reviews

- Positive Reviews

- Negative Reviews

- Comparison of Review Sources

- How This Report Helps Customers

- Recommendations for Allianz Partners USA

- Best Alternative Companies

Allianz Partners USA, a division of Allianz Global Assistance, is a leading provider of travel insurance and assistance services. Operating under the Allianz Travel Insurance brand, the company offers coverage for trip cancellations, medical emergencies, travel delays, and more. With over 25 years in the U.S. market and a global presence in 44 countries, Allianz protects over 70 million travelers annually. Headquartered in Richmond, Virginia, the company is backed by Allianz SE, a global insurance giant with an A+ financial strength rating from AM Best.

Company Website: www.allianztravelinsurance.com

Overall Rating: 7.8/10

Based on aggregated data from multiple review platforms, Allianz Partners USA earns a 7.8/10 rating. This score reflects strong customer satisfaction with ease of purchase and prompt reimbursements but is tempered by challenges in claims processing and communication.

Detailed Analysis of Customer Reviews

Positive Reviews

-

Ease of Purchase and Policy Clarity: Customers frequently commend the user-friendly online portal and mobile app (Allianz TravelSmart), which simplify purchasing policies and filing claims. For example, a Trustpilot reviewer noted, “The app’s sign-up system was seamless, and the policy language was easy to understand.”

-

Prompt Reimbursements: Many customers report fast claim processing for covered events like trip cancellations or medical emergencies. A ConsumerAffairs reviewer stated, “My travel delay claim was paid within a week, directly to my bank account.”

-

Comprehensive Coverage: Allianz’s plans, such as OneTrip Prime, are valued for covering trip cancellations, medical emergencies, and delays. A Forbes review highlighted “great medical evacuation limits of $500,000” and concierge services.

-

Peace of Mind: Frequent travelers appreciate the reliability of Allianz’s coverage. One reviewer on Trustpilot said, “We always buy Allianz for flights because you never know what life brings.”

-

Affordable Pricing: Policies start at $23 per trip, with competitive quotes for various trip types. A ConsumerAffairs review noted a $62 quote for basic coverage on a five-day trip to Mexico.

Negative Reviews

-

Claims Processing Issues: A common complaint is the complexity and delays in claims processing. A Trustpilot reviewer reported, “It took over two months to settle my claim, and I lost over $4,000 due to repeated document requests.”

-

Denied Claims: Some customers feel claims are unfairly denied, even for covered events. A ConsumerAffairs reviewer said, “They denied my claim for lack of documents despite uploading everything requested.”

-

Customer Service Challenges: Difficulties reaching representatives and poor communication are frequent issues. A BBB review stated, “The customer service line doesn’t work, and the contact page failed.”

-

Limited Coverage Details Pre-Purchase: Several reviewers noted that policy details are not fully disclosed until after purchase, leading to surprises. A reviews.io reviewer complained, “Policy details are unavailable until after buying, and they denied my covered event.”

-

Website Navigation: Trusted Choice highlighted that Allianz’s websites can be confusing, causing frustration when filing claims or accessing information.

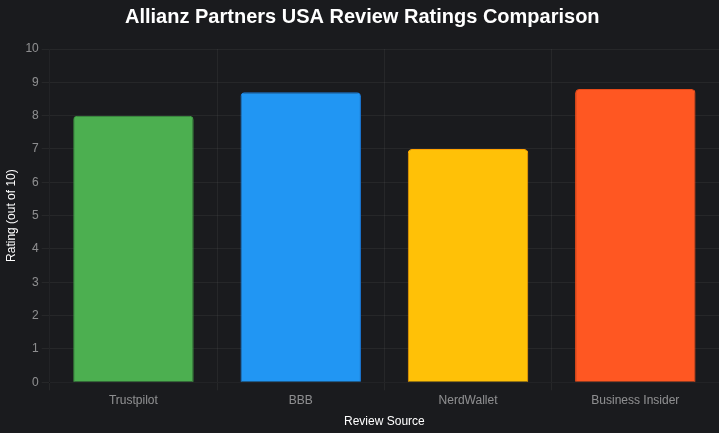

Comparison of Review Sources

-

Trustpilot: 4.1/5 from 130,369 reviews (recently updated). High volume of reviews reflects broad customer base, with 70% rating 4 or 5 stars. Positive feedback focuses on ease of use and quick payouts, while negatives center on claims disputes.

-

ConsumerAffairs: 3.8/5 from 6,821 reviews. Mixed feedback, with praise for coverage options but criticism for claim denials and dynamic pricing issues.

-

Better Business Bureau (BBB): A+ rating with 3.5/5 from customer reviews. Positive comments highlight helpful reps, but complaints focus on inaccessible customer service and delayed refunds.

-

Forbes Advisor: Rates Allianz highly for affordability and medical evacuation limits but notes low medical coverage ($50,000) and modest baggage delay benefits. Customer satisfaction is slightly below average at 81%.

-

NerdWallet: 3.5/5, praising medical benefits but criticizing limited customization and exclusions for extreme sports or natural disasters.

-

Reviews.io: 3.1/5 from 303 reviews, with harsher criticism for claim denials and poor customer service. Less representative due to smaller sample size.

-

Insureye: Highly negative, with multiple complaints about claim denials and unresponsive service. Limited sample size reduces reliability.

Analysis: Trustpilot and ConsumerAffairs provide the most robust data due to large review volumes, showing a balanced view. BBB’s A+ rating reflects strong business practices, but customer reviews are mixed. Forbes and NerdWallet offer expert insights, noting Allianz’s strengths in affordability but weaknesses in customization. Insureye and reviews.io are outliers with more negative tones, likely due to smaller, self-selecting samples.

How This Report Helps Customers

This analysis equips you with a clear picture of Allianz Partners USA’s strengths and weaknesses, helping you make an informed decision about travel insurance. If you value affordability, ease of purchase, and coverage for common issues like cancellations or delays, Allianz is a solid choice. However, if you anticipate complex claims or need highly customizable coverage, you may face challenges.

Recommendations for Customers:

-

Read Policy Details Carefully: Ensure you understand exclusions and coverage limits before purchasing. Request clarification from an agent if needed.

-

Document Everything: Keep detailed records of expenses, communications, and travel disruptions to streamline claims.

-

Use the Mobile App: The Allianz TravelSmart app simplifies claims and policy management, offering 24/7 assistance.

-

Purchase Early: Buy insurance soon after booking to maximize cancellation benefits and qualify for pre-existing condition waivers.

-

Contact Independent Agents: Work with an independent insurance agent for personalized guidance and better claims support.

Recommendations for Allianz Partners USA

-

Streamline Claims Processing: Reduce documentation requests and clarify requirements upfront to minimize delays and denials.

-

Enhance Customer Service Accessibility: Improve phone and online support availability, ensuring reps are easy to understand and responsive.

-

Increase Transparency: Provide detailed policy information before purchase to set clear expectations.

-

Upgrade Website Usability: Simplify navigation and fix technical issues on the claims portal, especially across browsers.

-

Expand Coverage Options: Offer more customizable plans, including coverage for extreme sports or “cancel for any reason” upgrades, to compete with rivals.

-

Address Negative Feedback: Actively respond to reviews on platforms like Trustpilot and BBB, demonstrating commitment to improvement.

Best Alternative Companies

-

Trawick International: Known for flexible plans and strong medical coverage, ideal for adventure travelers. Highly rated on Trustpilot (4.3/5).

-

World Nomads: Offers customizable policies for high-risk activities, with a 4.0/5 Trustpilot rating. Popular among younger travelers.

-

Travelex Insurance: Provides robust cancellation coverage and excellent customer service, with a 4.2/5 rating on ConsumerAffairs.

-

AXA Assistance USA: Competitive for medical and evacuation coverage, with a 4.1/5 Trustpilot rating and fewer claims complaints.

The Review

Allianz Partners USA enjoys a generally positive reputation, with a 4.1-star rating on Trustpilot from over 130,000 reviews and an A+ rating from the Better Business Bureau (BBB). Customers praise the straightforward policy purchase process, competitive pricing, and quick claim payouts for straightforward cases. However, negative feedback highlights inconsistent claims handling, excessive documentation requests, and difficulties reaching customer service. While many travelers value the peace of mind Allianz provides, others feel frustrated by denied claims and slow response times.